Invoicing under GST

TYPEOF INVOICE IN GST INDIA

In the GST regime, two types of invoices will be issued:

1. Tax invoice

2. Bill of supply

1. Tax Invoice

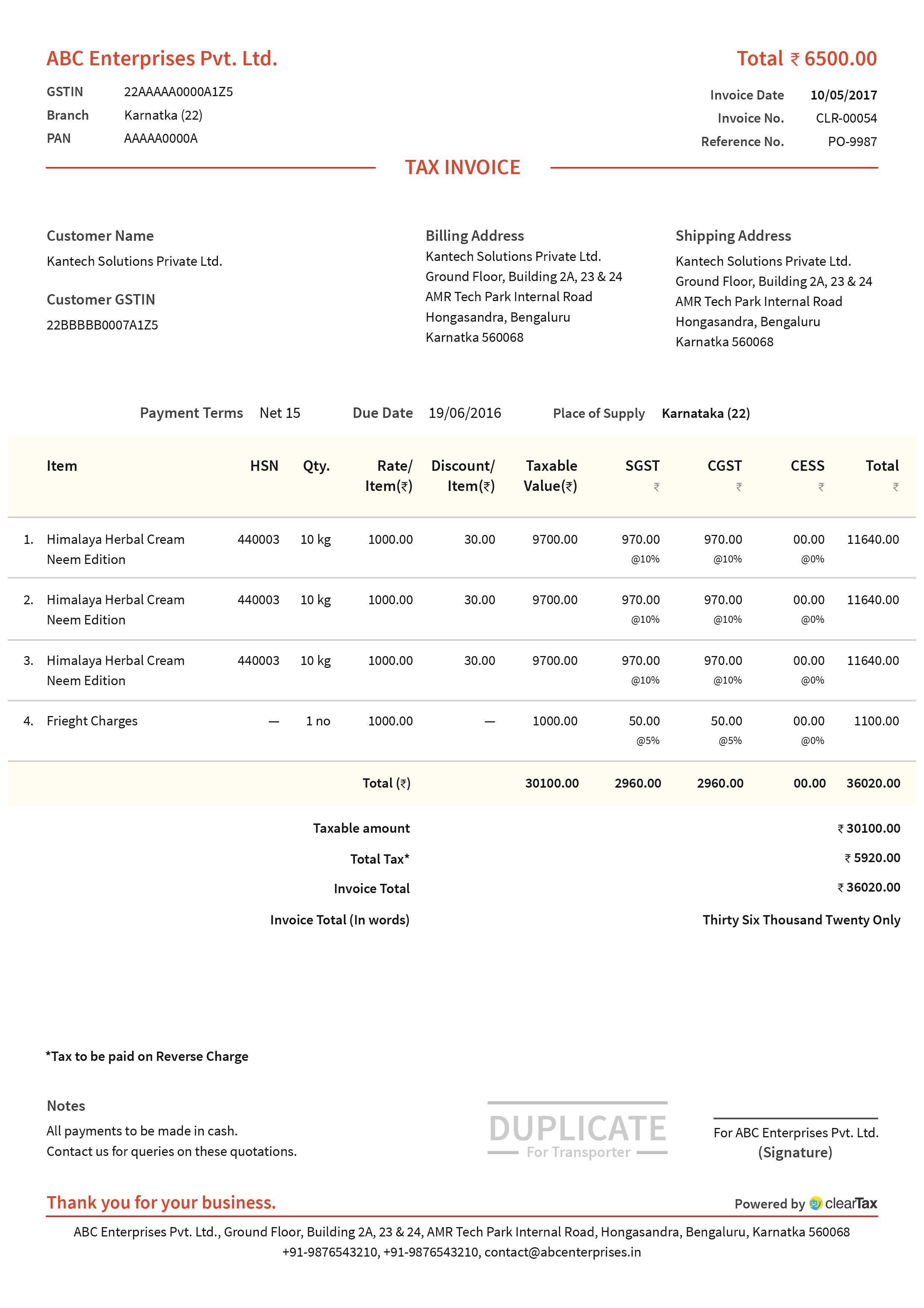

When a registered taxable person supplies taxable goods or services, a tax invoice is issued. Based on the rules regarding details required in a tax invoice, a sample tax invoice has been shown:

2. Bill of Supply

Tax invoice is generally issued to charge the tax and pass on the credit. In GST there are some instances where the supplier is not allowed to charge any tax and hence a Tax invoice can’t be issued instead another document called Bill of Supply is issued.Cases where a registered supplier needs to issue bill of supply:

- Supply of exempted goods or services

- Supplier is paying tax under composition scheme

How many copies of Tax Invoices are to be issued?

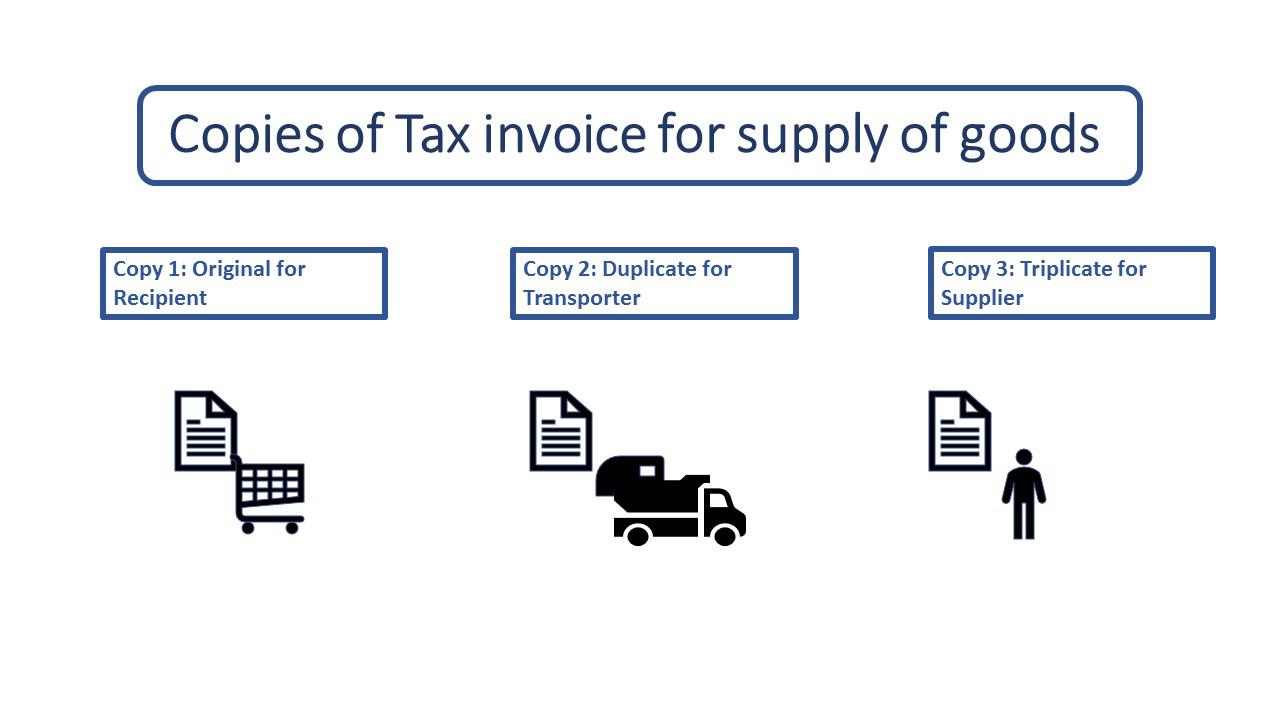

When goods are supplied, the supplier is required to issue three copies of the invoice– Original, Duplicate, and Triplicate.

Original invoice: When a buyer makes the purchase he gets the first copy of invoice, marked as ‘Original for recipient’.

Duplicate copy: The duplicate copy is issued to the transporter( carrier of goods) to present as evidence as and when required, and is marked as ‘Duplicate for transporter’. The transporter doesn’t need to carry the invoice if the supplier has obtained an invoice reference number.

Note: How to generate “Invoice Reference Number”?Triplicate copy: This copy is retained by the supplier for his own record.

The supplier can obtain an Invoice reference number from the common portal (GSTN) by uploading a tax invoice issued by him. The invoice reference number will be valid for 30 days from the date of uploading.

In the next article we will learn about the invoicing rules, format of invoices to be issued etc in case of supply of services by registered GST dealers.